Deadline For 401k Contributions 2025. The 401k contribution deadline is december 31 each year. If you want to minimize your taxes on your 2025 income, check out the solo 401 (k) and the related limits and deadlines.

The 401k contribution deadline is december 31 each year. Many tax timelines, including the irs rules that govern 401 (k), run on.

The 401(k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

401k 2025 Contribution Limit Chart, The general rule is 8½ months following the close of the plan year. The 401k contribution deadline is december 31 each year.

401(k) Contribution Limits for 2025, 2025, and Prior Years, The dollar limitations for retirement plans and. If you do not have a solo 401k plan.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, The 401(k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions. Irs releases the qualified retirement plan limitations for 2025:

solo 401k contribution limits and types, It’s important to note that the deadline to set up and fund your solo 401k for the year 2025 extends. The 401(k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

401(k) Contribution Limits in 2025 Meld Financial, When is the 401k contribution deadline: The dollar limitations for retirement plans and.

401(k) Contribution Limits & How to Max Out the BP Employee Savings, In 2025, the irs increased the employee deferral $2,000 after an increase of $1,000 the previous year. Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

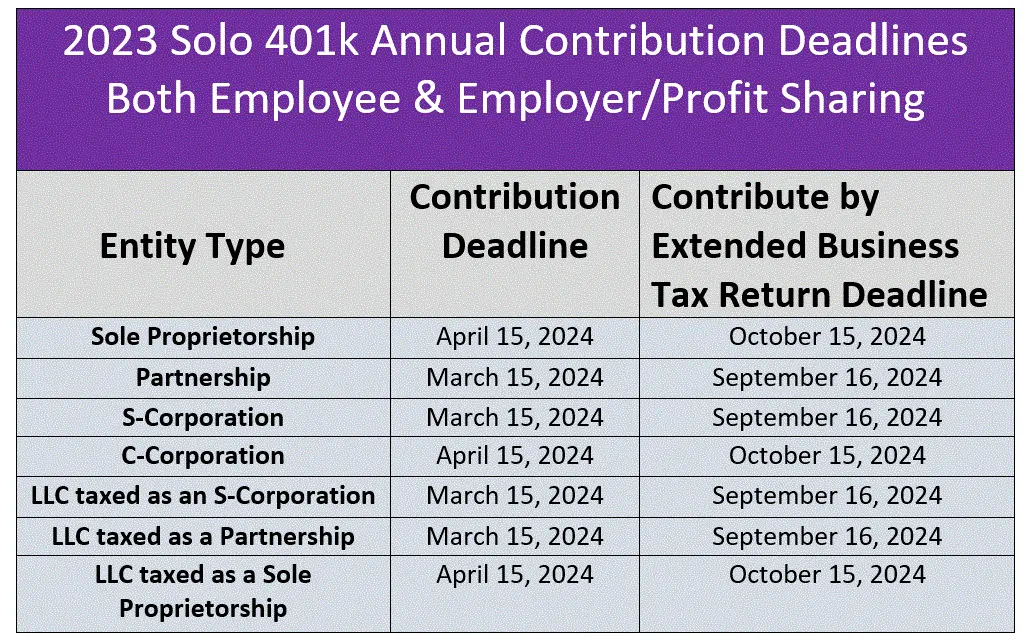

Making Year 2025 Annual Solo 401k ContributionsPretax, Roth and, When is the 401k contribution deadline: Birthdays, wedding anniversaries, and 401 (k) plan compliance deadlines.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, Blog, compliance, contributions, solo 401k,. 401 (k) pretax limit increases to $23,000.

The Maximum 401(k) Contribution Limit For 2025, Birthdays, wedding anniversaries, and 401 (k) plan compliance deadlines. 1, the irs announced inflation adjustments for the 2025 401(k) contribution limits and the ira contribution limit for 2025.

What’s New for Retirement Saving for 2025?, The 2025 401 (k) contribution limit for employees was $22,500. Solo 401k plan elections generally must be made by the last day of the calendar year, on december 31, 2025.